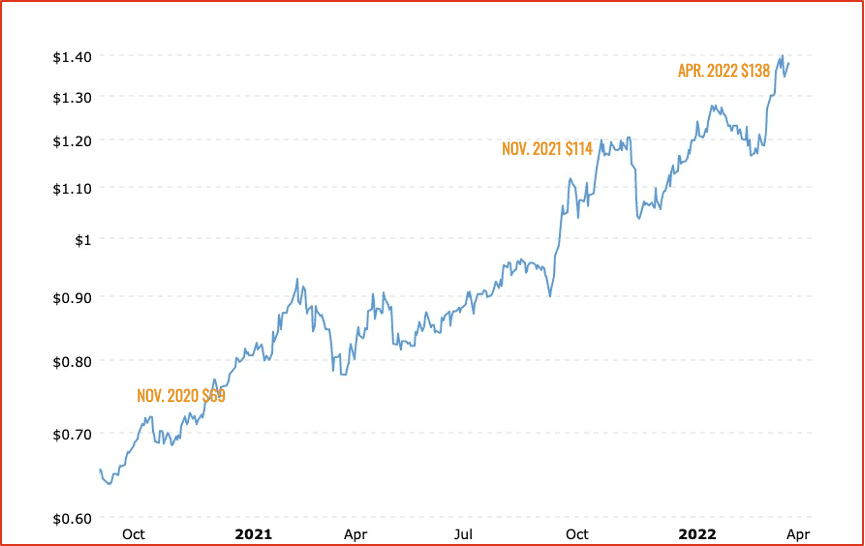

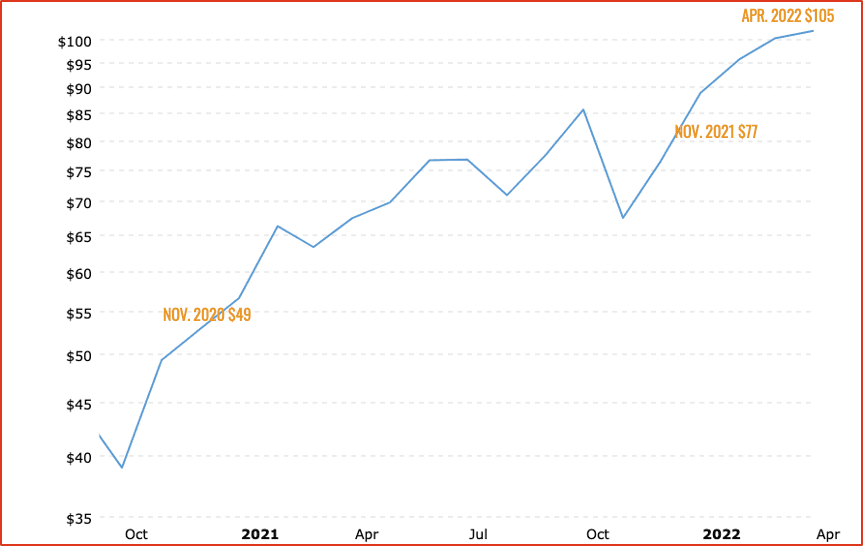

Crude Oil Forecast

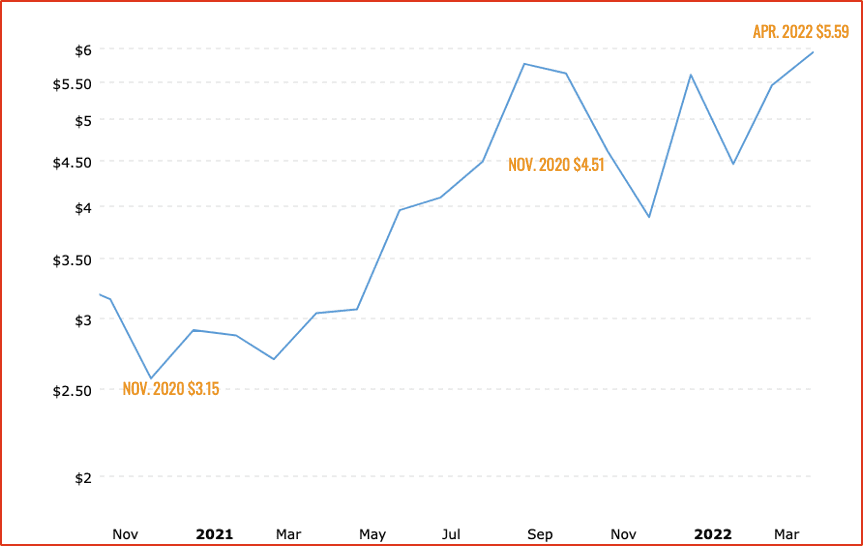

The forecast is not as transparent for crude oil. Russia’s invasion of Ukraine contributed to the recent sharp increase in crude oil prices.

While US-based oil will most likely stabilize at $113, the US Energy Information Administration (EIA) notes that Brent crude will rise to $116 for the second quarter.

“In our March 2022 Short-Term Energy Outlook (STEO), which was finalized on March 3, we increased our forecast price of international benchmark Brent crude oil to $116 per barrel (b) for the second quarter of 2022. We forecast that the price for WTI, the U.S. benchmark, will average $113/b in March and $112/b for the second quarter of 2022.”

-Source: EIA Short-Term Energy Outlook (STEO)- Presented Thursday, March 3, 2022