Examining 2021 Hospitality Shortages & Textile Manufacturing Challenges

There is a good chance the hotel you stay in this summer will have towels and sheets that look a bit old. The reason is that the property (and industry) will be short on replacements as textile manufacturing challenges continue to grow. The hospitality textile market in Q1 and Q2 of 2021 has seen its fair share of difficulties.

In my years as a CEO, distributing both hotel linens wholesale and retail textiles and janitorial supplies, I’ve never seen so many factors come into play simultaneously, thereby putting an entire industry into chaos.

Let’s begin with some obvious facts. In 2020 the COVID-19 epidemic rocked the travel industry. The U.S. Travel Association estimates that travel spending in 2020 was down 42%. Those numbers worsened from late March 2020 through the end of the year, totaling $492 billion in losses.

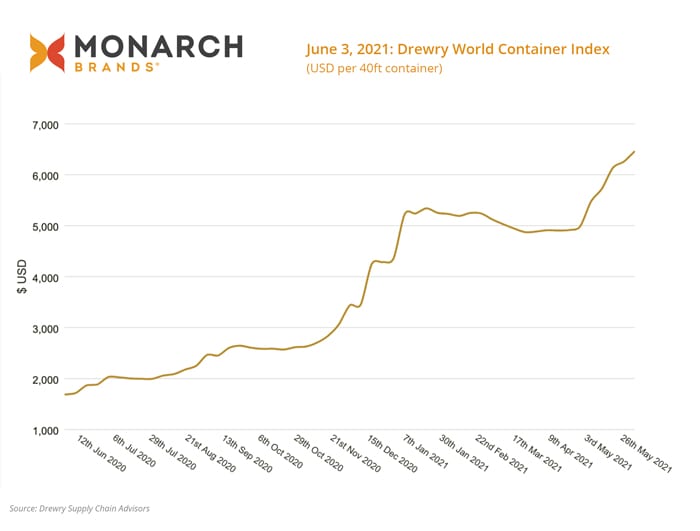

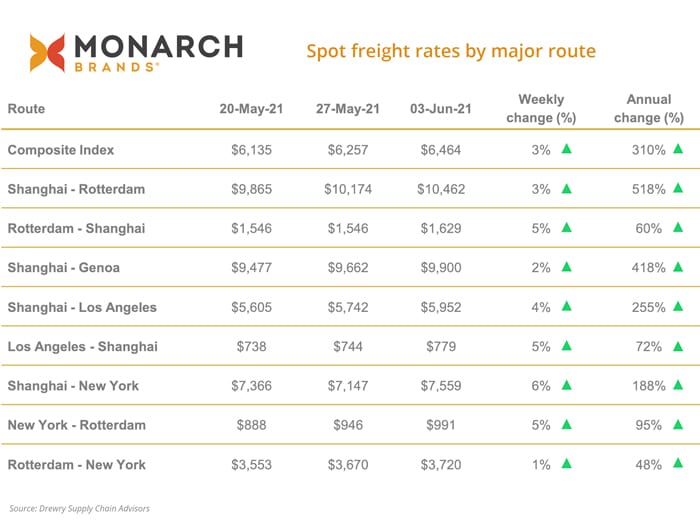

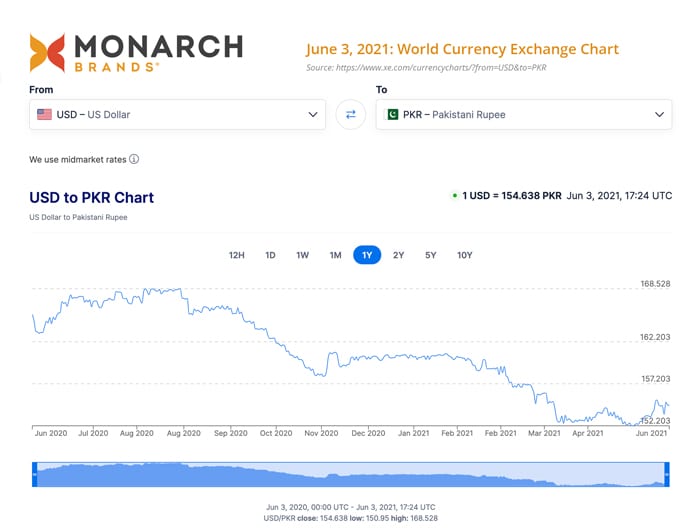

This, needless to say, had a rippling effect throughout the entire supply chain.